How might we...

...design an experience that ensures people feel confident in sharing their sensitive financial data.

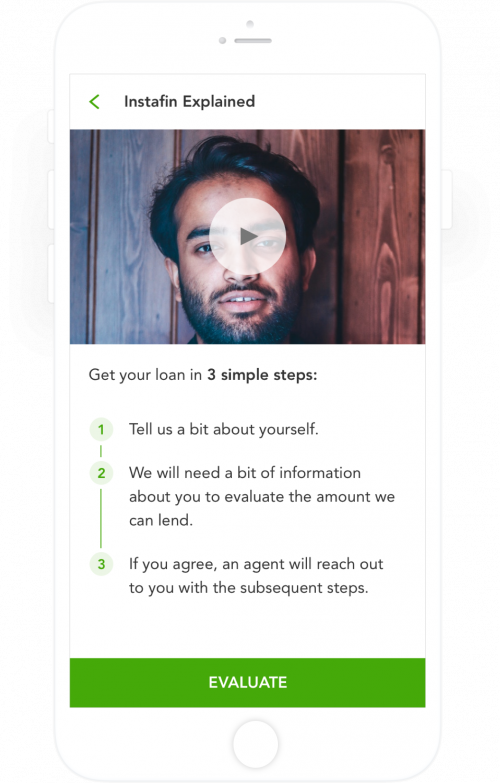

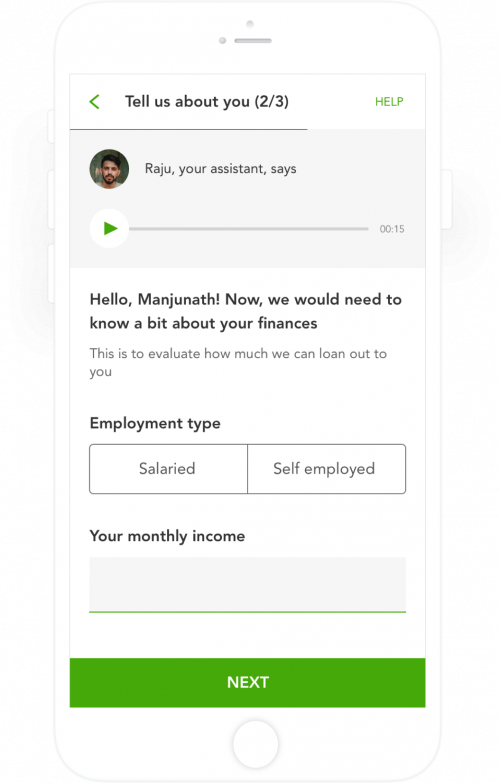

Audio and video can be great tools for explainability and building trust with people who are not comfortable with online interactions.

InstaFin is a digital-first lender that provides loans to individuals. The processing is paperless and the loans are accepted or rejected within 48 hours.

The app asks people to share information about their employment income and monthly expenses. This data is used to evaluate whether and how much credit can be extended to people. Later in the process people are required to share bank details and upload statements for the last 3 months. This data is used to authenticate income & expense information shared by them and process loan applications.

Financial inclusion has a big role to play in India’s overall economic growth. Digital-first lenders and investment platforms are trying to make that happen with minimal document requirements and end-to-end online processes.

While Fintech as an industry has made great progress, the acceptance of automation hasn’t grown at the same rate. People might be comfortable with online payments and digital transfers but when it comes to complicated processes like loans they still vary of uploading their documents online and sharing bank details. On the other hand, digital lenders while trying to make getting loans convenient for people still need to Know Their Customers and evaluate their creditworthiness.

How might we...

...design an experience that ensures people feel confident in sharing their sensitive financial data.

design an experience that ensures people feel confident in sharing their sensitive financial data.

When building for financial inclusion adopting a localised approach can be the key to success.

Giving people multiple language options in a multilingual country seems like such an obvious solution but it is also a very effective one.

Communication is key and simple suggestions from a digital assistant communicating in a language you understand can be extremely comforting

People who are not comfortable with online interactions might get overwhelmed with too much text or inputs required by them while onboarding. Hand holding them throughout the process as well as giving it a human touch will demystify the technology for them.

Having voice-based explanations makes the information more understandable for people.

The reason for adding a phone number to connect with a real person makes the process more comforting for non-tech savvy people.

Someone who is interacting with a digital lender for the first time might not be comfortable uploading documents as it is very sensitive data.

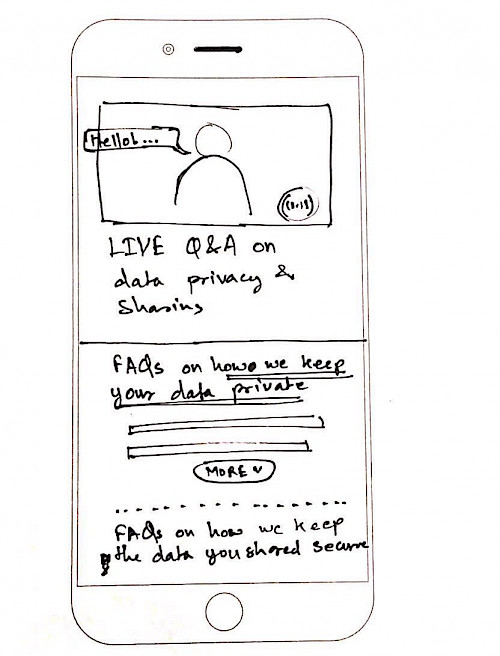

How Might We build on InstaFin’s idea to empower people with clear information on data privacy and sharing?